Choosing the right loan can feel overwhelming, but with a little research and understanding, you can make an informed decision. Whether you're looking for a personal loan, a mortgage, or a business loan, there are a few key factors you need to consider. In this blog post, we will guide you through everything you need to know before choosing the best loan for your situation.

Assessing Your Financial Situation

Before applying for any loan, it's crucial to understand your financial situation. Take a good look at your income, existing debts, and credit score. Knowing how much you can afford to borrow is key to avoiding loan stress down the line.

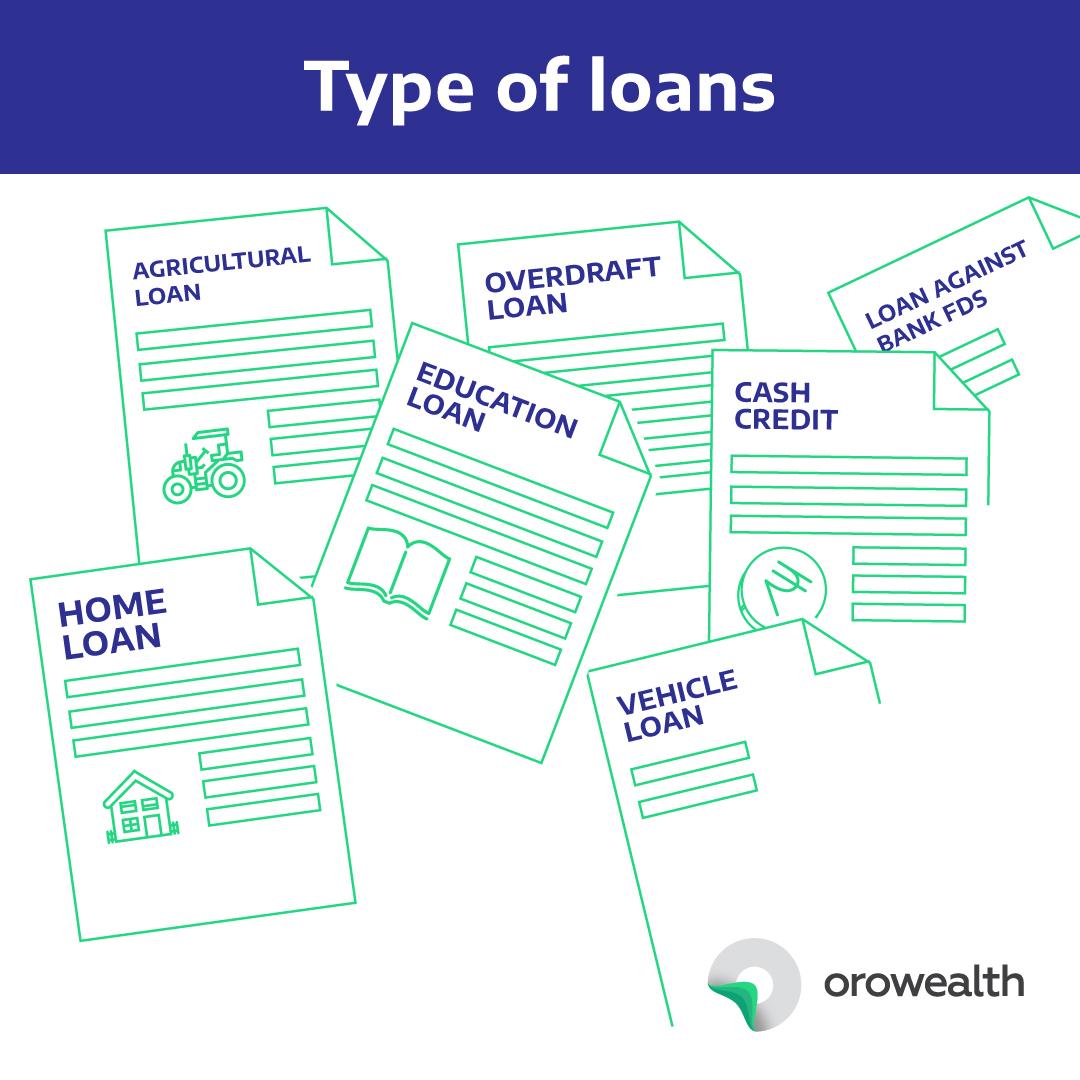

Understanding Loan Types

There are many types of loans available to consumers, each designed for specific needs:

- Personal Loans: Great for consolidating debt or covering unexpected expenses.

- Home Loans: For purchasing or refinancing your home. These usually come with lower interest rates.

- Business Loans: Used to fund startup costs, expansions, or operating capital for businesses.

Comparing Interest Rates

The interest rate is one of the most important factors to consider when comparing loan options. A lower rate will save you money over the life of the loan, so always shop around for the best rate available to you.

Loan Terms and Repayment Plans

Each loan comes with a repayment plan that outlines how long you’ll have to repay the loan and how much you’ll pay monthly. Consider whether a shorter loan term with higher payments fits your budget, or if a longer term would work better for you.

Fixed vs. Variable Rates

Some loans come with fixed interest rates, meaning the rate stays the same for the life of the loan. Others offer variable rates, which can change over time based on market conditions. Understand the pros and cons of both to choose the best option for your finances.